Corporation | Departments | Tax calculation structure for property tax

Know your property tax calculation structure

Introduction

Within the AMC limits, all properties are assessed and tax is collected by the Assessment and Tax Collection Department.

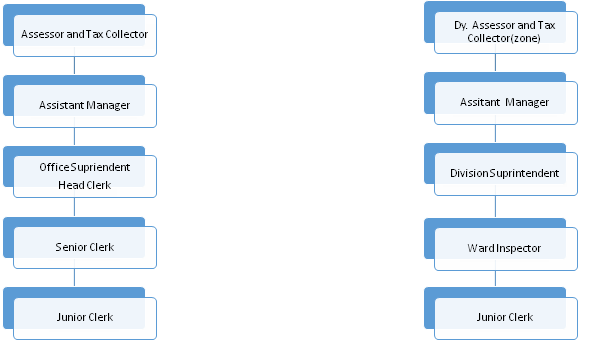

Organization Structure of the Department

Details of Officials of the Department

| Sr.no. | Zone | Office Address | Name of Officer | Designation |

| 1 | TAX CENTRAL OFFICE | 5th Floor, Old Mun. Building SardarPatel Bhavan, Danapith | Shri Debashish Banerjee | Assessor and Tax Collector |

| 2 | CENTRAL | 5th floor,Old Mun. Building Sardar Patel Bhavan, Danapith | Shri prashant Vora | Dy.Assessor& Tax Collector |

| 3 | NORTH | Rajiv Gandhi Bhavan, Memco Char Rasta, Naroda Road | Shri Dilip Patel | Dy.Assessor& Tax Collector |

| 4 | SOUTH | Shyamprasad Mukherjee Bhavan, Rambaug,Opp.Fire Station, Maninagar | Shri Akhilesh Brahmbhatt | Dy.Assessor& Tax Collector |

| 5 | EAST | Harubhai Mehta Bhavan Virat Nagar Char Rasta | Shri Prashant Shah | Dy.Assessor& Tax Collector |

| 6 | WEST | Dr.Ramanbhai Patel Bhavan,Usmanpura CharRasta | Shri Dipak Patel | Dy.Assessor& Tax Collector |

| 7 | NORTH WEST | Near Atithi Dining Hall,Near Deep Tower, InThe Lane of Shradha Petrol Pump, Bodakdev | Shri Mukesh Patel | Dy.Assessor& Tax Collector |

| 8 | SOUTH WEST | Late. Shri Tushar Deshmukh Bhawan, South West Zone Office, Near Shalby Hospital, Corporate Road, Jodhpur, Ahmedabad | Shri Umang Shah | Dy.Assessor& Tax Collector |

To start with, first General Tax is calculated as per following:

General tax is calculated on carpet area of the property.

There are mainly 4 factors based on which general tax is calculated.

F1: Location factor

F2: Age factor

F3: Usage of the property

F4: Occupancy factor

| Rate: (For 2025-26) | For Residence | Rs.20.80/- per sq. meter |

| For non-residence | Rs.35.36/- per sq. meter |

| Residence & non-residence | Factor |

|---|---|

| Posh area (Land jantri value is and above Rs 22001) | 1.60 |

| Good area (Land jantri value is between Rs 13501 and Rs 22000) | 1.10 |

| Medium area (Land jantri value is between Rs 6751 and Rs 13500) | 0.90 |

| Poor area (Land jantri value is and below Rs 6750) | 0.60 |

| Age of Building | Factor |

|---|---|

| < 10 years | 1.00 |

| > 10 years to 20 years | 0.85 |

| > 20 years to 30 years | 0.70 |

| > 30 years to 40 years | 0.60 |

| > 40 years | 0.50 |

For Residence:

| Type of Building | Factor |

|---|---|

| Individual Bungalow | 1.50 |

| Tenement | 1.00 |

| Row House | 1.00 |

| Flat | 0.70 |

| Gamtal | 0.70 |

| Pole | 0.70 |

| Chawl (More than 25 sq.mts) | 0.50 |

For Non-Residence: Usage Factor

The designated rate shall be neither be increased nor be decreased having regard to the purpose for which the buildings other than residential are used, as follows, namely: -

(a) The designated rate shall be increased by multiplying it-

1. Commercial properties by 7.0 in respect of the buildings used as under: -

Bank, Dispensary, Hospital, Clinic, Maternity home, Laboratory, Central Government office, State Government office, Local bodies office, Post office, Commercial and / or industrial office, Oil company's office, Offices of Corporations, Tuition classes, typing institute, godowns and ware houses of the properties falling in the above categories and those buildings which do not fall within any other sub-clause of this clause.

2. Commercial properties by 6.0 in respect of the buildings used as under: -

Shop, Hotel, Restaurant, Entertainment Places, Open air theatre, Petrol pump, Service station, Cinema, Club house, Gymkhana, Clubs, mess, Lodging, Lodging and Boarding, Party plots (except community halls), Dish antennae, Pager Antenna towers, Signboard, hoarding, Mobile phone towers, godowns and warehouses of the properties falling in the above categories.

3. Industrial Units & Factories (only processing & manufacturing units) by 2.0 in respect of the buildings used as under: -

Electricity Power House, Electric substation, Aerated Water Factory, Bhattha, Brass Works, Brick and ceramic works, Cement Articles, Clay Mfg. unit, Chemical Factory, Confectionery, Dairy, Distillery, Foundry, Flour Factory, Iron Factory, Zinc Factory, Silver ornament Factory, Jaggary manufacturing unit, Leather manufacturing unit, Lime chakki, Lime bhatthi, Oil extraction, Paper manufacturing, Plastic Factory, Pottery, Sagol manufacturing, Soap manufacturing, Sugar manufacturing, Tin Factory, Tobacco Factory, Workshop, Factory Steam-Gill, Auto-Garage, Factory A, B, C, D, E, F, Mill, Power loom, Hand loom, Bleaching, Bone washing, cotton spinning & dyeing, dyeing bleaching, Dhana-dal Factory, Leather processing, Screen printing, Sulphur processing, Starch processing, Variyali processing, Wool processing, Cold storage, Woodpitha, Bhathiyarkhana, Repairing works, Nursery (flower plants) Animal market, Cattle stable, Poultry farm, Kennel, Milk cattle stable, Weigh bridge, Binding press, Printing press, Process studio, Photo studio, Common effluent treatment plant, Godowns and Warehouses of the properties falling in the all above categories.

4. Educational & Social Institutions by 2.0 in respect of the buildings used as under: -

Private Nursery (Bal-Mandir), Private and Govt. Schools, Private and Govt. Colleges, University campus, Museum, Community halls, social institutes run by public charitable trust (for the welfare of women, old people, deaf, dumb and blind, physically handicapped, mentally retarded people) and non-grantable schools.

5. By 1.0 in respect of the buildings used as under: -

Water tank, Water pumproom, Drainage pumping stations, Dhobighat, Grantable schools run by Public Charitable Trust, Boarding-Lodging-Hostels run by Public Charitable Trust and Religious Institutions, Dharma-shala, Ashram, Library.

6. By 0.0 in respect of the buildings used as under: -

Temple, Mosque, Derasar (Jain Temple), Church, Roza, Tombs, Gurudwara (Sikh Temple), Apasara, Darga, Agiyari, Samadhi, Graveyard, Kabrastan, crematorium, well, havada, hamamkhana (public bath), mattina akhada, madrasa, pathshala, free water parab

| Type | Residence Factor | Non Residence Factor |

|---|---|---|

| OWNER | 1.00 | 1.00 |

| TENANT | 1.00 | 2.00 |

| Use of Prop | Water Tax | Conservancy Tax |

|---|---|---|

| RESIDENTIAL PROP. | 30% of Gen Tax | 30% of Gen Tax |

| NON-RESIDENTIAL PROP | ||

| FOR PROPERTIES HAVING USAGE FACTOR - 7 | 35% of Gen Tax | 35% of Gen Tax |

| FOR PROPERTIES HAVING USAGE FACTOR - 6 | 40% of Gen Tax | 40% of Gen Tax |

| FOR PROPERTIES HAVING USAGE FACTOR - 2 | 35% of Gen Tax | 35% of Gen Tax |

| FOR PROPERTIES HAVING USAGE FACTOR - 1 | 30% of Gen Tax | 30% of Gen Tax |

| Sr. No. | Type of Building | Property Area in Sq.mts. | Minimum General Tax |

|---|---|---|---|

| 1 | Huts | - | 84/- |

| 2 | Chawl | Less than 25 sq.mts | 264/- |

| 3 | Other | Less than 30 sq.mts | 264/- |

| 4 | Other | 30 sq.mts to 50 sq.mts | 300/- |

| 5 | Other | 50 sq.mts. | 330/- |

| S.No. | Type of Building | Property Area in Sq.mts. | Minimum General Tax |

|---|---|---|---|

| 1 | Non-residence | Less than 15 sq.mts | 540/- |

| 2 | Non-residence | 15 sq.mts to 30 sq.mts | 660/- |

| 3 | Non-residence | > 30 sq.mts | 780/- |

| 4 | In some non-residence usage of properties. | - | 900/- |

DOOR TO DOOR GARBAGE COLLECTION USER CHARGE- (From 01-10-2018)

| USE OF PROPERTIES | RATE(Rs.) |

|---|---|

| RESI PROP. | |

| Hut | 0 |

| Affordable Housing, EWS Prop (>30 sqm) | 50 paisa/ day |

| Other Resi prop | 1 Re. /Day |

| NON RESI PROP. | |

| > 50 Sq. metres | 1 Re. /Day |

| 50 Sq. metres or more | 2 Re. /Day |

ENVIORNMENT IMPROVEMENT CHARGE (EIC CHARGE)

| Area Range (Sq. M.) | Resi Property EIC (Rs) | Non Resi Property EIC (Rs) |

|---|---|---|

| 0 - 15 | 5 | 75 |

| > 15 - 25 | 10 | 150 |

| > 25 - 50 | 40 | 300 |

| > 50 - 100 | 50 | 500 |

| > 100 - 200 | 150 | 1000 |

| > 200 - 400 | 500 | 1500 |

| > 400 - 500 | 750 | 2000 |

| > 500 | 1000 | 3000 |

| RESI | NON-RESI | |

|---|---|---|

| GENERAL TAX | % OF GENRAL TAX | % OF GENRAL TAX |

| UP TO 200 Rs. | EXEMPT | EXEMPT |

| 201 TO 500 Rs. | 5 | 10 |

| 501 TO 3000 Rs. | 10 | 20 |

| 3001 Rs. AND ABOVE | 15 | 30 |

For example, a citizen is living in a flat in Gurukul road area of Ahmedabad city, having following details

Carpet area of the flat: 83.85 sq mtr

Age of the building: 25 yr old

Usage: Residence, flat

Occupancy: owner based

then the property tax will be calculated as per below

| Factor | Description | Rate |

|---|---|---|

| Type of Property | Residential | 20.80 |

| Building Type | Flat | 0.70 |

| Type of Occupancy | Self | 1.00 |

| Location Factor | Prosperous | 1.10 |

| Government Building | No | - |

| Water Zone | Yes | - |

| Building Age | 25 | - |

| Age Factor Rate | 0.70 | - |

| Sr. No. | Floor Description | Construction Year | Age Factor Rate (F2) | Carpet Area | Gross Tax = R*F1*F2*F3*F4 | Discount Rate % | Net Tax |

|---|---|---|---|---|---|---|---|

| 1 | Above First Floor | 2000 | 0.7 | 83.85 sq.mtr | 940 | 0.00 | 940 |

| Total Area | 83.85 sq.mtr | Total Tax | 940 | ||||

| Net Tax | 940 | ||||||

| Water Tax | 282 | ||||||

| Conservancy Tax | 282 | ||||||

| Usage Charge | 365 | ||||||

| EIC Charge | 50 | ||||||

| Education Cess | 94 | ||||||

| Service Tax | 0 | ||||||

| Estate Rent | 0 | ||||||

| Total Property Tax | 2013 | ||||||

For example, a citizen is having in a shop in Kalupur area of Ahmedabad city, having following details

Carpet area of the flat: 160 sq mtr

(40 sq mtr in cellar, 40 sq mtr in GF, 40 sq mtr in FF, 40 sq mtr in SF)

Age of the building: 19 yr old

Usage: Non Residence, shop

Occupancy: owner based

then the property tax for f.y. 2025-26 will be calculated as per below

| Factor | Description | Rate |

|---|---|---|

| Type of Property | Non-Residential | 35.36 |

| Building Type | Shop | 6.00 |

| Type of Occupancy | Self | 1.00 |

| Location Factor | Prosperous | 1.10 |

| Government Building | No | - |

| Water Zone | Yes | - |

| Building Age | 19 | - |

| Age Factor Rate | 0.85 | - |

| Sr. No. | Floor Description | Construction Year | Age Factor Rate (F2) | Carpet Area | Gross Tax = R*F1*F2*F3*F4 | Discount Rate % | Net Tax |

|---|---|---|---|---|---|---|---|

| 1 | Cellar | 2006 | 0.85 | 40.00 sq.mtr | 7935 | 20.00 | 6348 |

| 2 | Above First Floor | 2006 | 0.85 | 40.00 sq.mtr | 7935 | 20.00 | 6348 |

| 3 | First Floor | 2006 | 0.85 | 40.00 sq.mtr | 7935 | 20.00 | 6348 |

| 4 | Ground Floor | 2006 | 0.85 | 40.00 sq.mtr | 7935 | 0.00 | 7935 |

| Total Area | 160 sq.mtr | Total Tax | 26979 | ||||

| Net Tax | 26979 | ||||||

| Water | 10792 | ||||||

| Conservancy Tax | 10792 | ||||||

| Usage Charge | 730 | ||||||

| EIC Charge | 1000 | ||||||

| Education Cess | 8094 | ||||||

| Service Tax | 0 | ||||||

| Estate Rent | 0 | ||||||

| Total Property Tax | 58387 | ||||||

Services offered by the

Department:

1- More than 61 city civic centers are being run by AMC for citizens, for payment of tax at the nearest area of their premises.

2- Common database to facilitate online access

3- Citizen can access their tax calculation details,tax dues and paid details on website www.egovamc.com in property tax module.

Forms & Documents for Download: